tv World Business Report BBC News March 28, 2024 11:30am-11:46am GMT

11:30 am

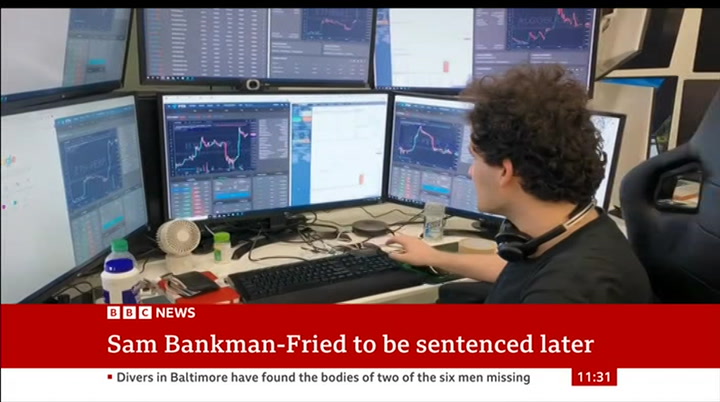

a reckoning for the fallen crypto king. sam bankman—fried is to be sentenced in the next few hours for stealing billions of dollars from customers of his ftx exchange. he faces decades behind bars. the crisis at thames water deepens as shareholders refuse to inject extra cash into the uk's largest water company. hello and welcome to world business report, i'm lukwesa burak. we start in the us, where in the next few hours sam bankman—fried — the former cryptocurrency tycoon, convicted of stealing billions of dollars from customers — will be sentenced for his crimes. the 32—year old founder of

11:31 am

the collapsed crypto exchange ftx could now face decades in prison. our cyber correspondent, joe tidy, was the last person to interview bankman—fried before he was arrested in december 2022 and reports on the rise and downfall of the man behind one of the biggest financial crimes in us history. one interesting thing that's been happening pretty recently is that the bitmex bitcoin perpetual futures ran up a lot in price. this was sam bankman—fried in his element — at his desk, talking crypto and making incredible profits. his hair and shabby look were all part of the appeal and brand. sbf, as he was known by legions of fans online, portrayed himself as a maths genius who wasn't interested in personal wealth. it was all about developing the cryptocurrency industry and giving to charities. this is big. but ftx, his cryptocurrency exchange that sold bitcoin and other virtual currencies for normal money, like pounds and dollars, grew to be the centrepiece

11:32 am

of a sprawling business worth $32 billion. so, when it all came crashing down in december 2022, more than a million customers were left out of pocket. in a high—profile trial in new york in november, he was convicted of seven counts, including fraud and money laundering. sam bankman—fried perpetrated one of the biggest financial frauds in american history, a multi—billion dollar scheme designed to make him the king of crypto. but here's the thing — the crypto the cryptocurrency industry might be new. the players like sam bankman—fried might be new. but this kind of fraud, this kind of corruption, is as old as time, and we have no patience for it. the court case saw his former staff and even his girlfriend testify against him. his chief crime was that he illegally used customer deposits from ftx to fund his other business. prosecutors are asking the judge to sentence him to 50 years in prison,

11:33 am

but his defence team want around five years. they argue that most of the billions of dollars bankman—fried lost have now been recovered, but critics say he shows no remorse. in an interview in his luxury apartment complex in the bahamas just before he was arrested, he admitted to making mistakes but claimed it wasn't deliberate. were you incompetent or were you fraudulent? i didn't knowingly commit fraud. i don't think i committed fraud. i didn't want any of this to happen. i was certainly not nearly as competent as i thought i was. but a convicted criminal he now is. and it's up to a judge to decide how long he'll be behind bars for one of the biggest financial crimes in us history. joe tidy, bbc news. david gerard is the author of the attack of the 50 foot blockchain. welcome to the programme. you know, he fooled a lot of people as we

11:34 am

heard in that report, is it still something of the wild west in cryptoworld? it something of the wild west in cryptoworld?— something of the wild west in c toworld? , , cryptoworld? it is the wild west, ftx cryptoworld? it is the wild west, m turned _ cryptoworld? it is the wild west, ftx turned out _ cryptoworld? it is the wild west, ftx turned out to _ cryptoworld? it is the wild west, ftx turned out to be _ cryptoworld? it is the wild west, ftx turned out to be a _ cryptoworld? it is the wild west, ftx turned out to be a hot - cryptoworld? it is the wild west, ftx turned out to be a hot air i ftx turned out to be a hot air balloon and it popped. the largest cryptoexchange admitted to being a criminal conspiracy to commit money laundering. that exchange is still going, so you can make money in crypto but you should tread carefully. crypto but you should tread carefully-— crypto but you should tread carefull . ~ . , ., , carefully. what lessons have been learned? the _ carefully. what lessons have been learned? the main _ carefully. what lessons have been learned? the main lesson - carefully. what lessons have been learned? the main lesson is- carefully. what lessons have been learned? the main lesson is whenj learned? the main lesson is when ever anyone _ learned? the main lesson is when ever anyone talks _ learned? the main lesson is when ever anyone talks techno - learned? the main lesson is when ever anyone talks techno babble, | ever anyone talks techno babble, don't listen. i know the technology, it is not remarkable. crypto is a way to construct financial instruments out of the sight of

11:35 am

regulators and now we are getting a reminder why regulations exist. they're there to protect you. you can make big money in the wild west and you can lose your shirt and usually you will be the big guy they're making their money from. this is why we have regulation and they're starting to prosecute people. sam bankman—fried is the first. people. sam bankman-fried is the first. . ., , people. sam bankman-fried is the first. . ., first. the prosecutions are coming in, accountability _ first. the prosecutions are coming in, accountability is _ first. the prosecutions are coming in, accountability is coming - first. the prosecutions are coming in, accountability is coming in, - first. the prosecutions are coming l in, accountability is coming in, how has the crypto—industry evolved? are we any closer to regulation since 2022? ,., , ., ., 2022? the point is to evade regulation _ 2022? the point is to evade regulation that _ 2022? the point is to evade regulation that is _ 2022? the point is to evade regulation that is the - 2022? the point is to evade regulation that is the only l 2022? the point is to evade l regulation that is the only use 2022? the point is to evade - regulation that is the only use of crypto working around rules. you could make a moral case, but mostly regulations exist for reasons. without that unique selling point, crypto doesn't have a lot to do. anything it does you can do better

11:36 am

with proper financial instruments. the point is to work around regulations, you know. and it is not a sustainable mode of business really. a sustainable mode of business reall . ., ~' ,, to the spanish island of ibiza now and the soaring cost of a place to live. in many parts of spain, rental costs have risen steeply in recent years. but in the tourist hotspot of ibiza, the rise has been magnified by the influx of foreign visitors. and that has left many locals unable to find affordable accommodation — and businesses struggling to find vital staff. guy hedgecoe reports. ibiza is preparing for the summer tourist season. beaches and resorts have long been a magnet for holiday—makers. but its success has helped

11:37 am

create a housing crisis. across the balearic islands, rental costs have increased by nearly 20% over the last year alone, and in ibiza the increases have been even sharper. there are several reasons for the steep rises. higher interest rates and a higher cost of living have discouraged people from purchasing property. that, in turn, leads to an increase in demand for rented accommodation, pushing up rental rates. tourism is also a major factor. last year, 3.7 million people visited ibiza and the neighbouring island. many stay in flats, pushing up rental prices and keeping locals out of the housing market. this man is a chef and although he has work, he has been sleeping in his car

11:38 am

for the last three years. something that many workers on the island now resort to. translation: in ibiza, accommodation is expensive and is getting more and more expensive. with cost of renting completely out of kilter with what you earn. there comes a moment when you say i cannot do this any more. i need a house. local activists are demanding that this phenomenon be stopped. translation: the problem we have is that the island's housing is not being used for the purpose for which it was built. it is being used as a speculative business and for tourism. this situation is affecting local businesses. the old beach disco and restaurant is preparing for the high season. but finding staff in ibiza or from elsewhere is not easy.

11:39 am

i have friends on the island whose i rent has doubled in the last yearl so when you look at workers coming to the island, it is a massive - factor and well—known, - so i think it will ultimately affect people coming to the island and i getting workers to come to ibiza. the local authorities say the housing crisis caused by home owners who break the law by offering their properties to rent for short period. you earn more renting for days or weeks than if you rent according to the law, which is at least six months. we have a lot of people who is renting illegally, offering their properties illegally. figs is renting illegally, offering their properties illegally.— properties illegally. as the high season approaches, _ properties illegally. as the high season approaches, the - properties illegally. as the high l season approaches, the question properties illegally. as the high - season approaches, the question is whether ibiza's success can be sustained when housing is such a problem. here in the uk, thames water is in a race to find extra cash

11:40 am

after its investors said they would not give the struggling water giant extra cash unless customers' bills rise. the uk's largest waterfirm has been pushing for the regulator, ofwat, to agree to a substantial increase in water bills over the next five years. fears emerged last year that thames could collapse due to its huge debts. gill plimmer is the infrastructure correspondent at the ft, who has been covering the story. could you paint the picture for us, what kind of shape is thames water in and are those underlying issues characteristic of the wider industry?— characteristic of the wider indust ? ,, ., ., , . ., industry? sure. i mean thames water has £80 billion _ industry? sure. i mean thames water has £80 billion of— industry? sure. i mean thames water has £80 billion of debt _ industry? sure. i mean thames water has £80 billion of debt that _ industry? sure. i mean thames water has £80 billion of debt that it - has £80 billion of debt that it needs to service and essentially it is saying it hasn't quite got enough to keep going the company. it has

11:41 am

been hit by higher interest rates on that debt and all the money comes out of the customers' bills, so a greater share is going to paying off that debt orjust paying that debt. and so it has asked shareholders to put in equity and so far they're refusing on the grounds that ofwat is saying that they need to put more money in and they need to, they want ofwat to make some concessions. that includes a big increase in customer bills. they want a 56% increase in bills. they want a 56% increase in bill after inflation and concessions on regulatory fines, because... sounds like the burden then is, could be placed on customers. what sort of reaction has there been to that? ., , , ., ., ., .,

11:42 am

that? there has been a lot of anger, --eole are that? there has been a lot of anger, people are furious _ that? there has been a lot of anger, people are furious around _ that? there has been a lot of anger, people are furious around sewage i people are furious around sewage outflows and people are saying there has been a massive backlog of infrastructure investment that hasn't been done. why hasn't it been done? and why should we pay for that now when companies have clearly taken healthy dividends out of companies. taken healthy dividends out of companies-— taken healthy dividends out of comanies. ., ., ., companies. what options are on the table? well, — companies. what options are on the table? well, i _ companies. what options are on the table? well, i guess— companies. what options are on the table? well, i guess one _ companies. what options are on the table? well, i guess one is - companies. what options are on the table? well, i guess one is that - companies. what options are on the table? well, i guess one is that the | table? well, i guess one is that the re . ulator table? well, i guess one is that the regulator ofwat _ table? well, i guess one is that the regulator ofwat simply _ table? well, i guess one is that the regulator ofwat simply gives - table? well, i guess one is that the regulator ofwat simply gives in - table? well, i guess one is that the regulator ofwat simply gives in and j regulator ofwat simply gives in and agrees to the concessions that the shareholders are asking for and agrees to increase bills.- shareholders are asking for and agrees to increase bills. thank you. that is world _ agrees to increase bills. thank you. that is world business _ agrees to increase bills. thank you. that is world business report. - that is world business report. lauren is with you in a short moment.

11:45 am

hello from the bbc sport centre. we start in the nba, where the golden state warriors overcame the early ejection of forward draymond green to defeat the orlando magic and stay in the race for a post—season place. it happened in the first quarter when green objected to a foul called on team—mate andrew wiggins and was given a technical for remonstrating with the officials. he then received a second and was ejected for the fourth time this season. team—mate steph curry wasn't impressed but turned his focus on orlando. this three pointer with 33 remaining gave the warriors a 101 to 93 win. they're 10th in the western conference. we need him. he knows that. we all know that. so whatever it takes to keep him on the floor, he'll be available... that's what's got to

16 Views

IN COLLECTIONS

BBC News Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11