tv Alex Tapscott Web3 CSPAN March 28, 2024 10:22am-11:17am EDT

10:23 am

been waiting for. to hear from alex tapscott, the bestselling author himself. i'm pleased to introduce him. alex is an entrepreneur, a business author, a seasoned capital markets professional, focused the impact of emerging technologies such as blockchain and cryptocurrency, business, government and, society. alex has been also the coauthor of, critically acclaimed nonfiction bestseller blockchain revolution, which i mentioned earlier. it was really a life book for me that changed the trajectory. my career and really my life. it has been translated into more than 19 languages and it has sold more than half a million copies worldwide. his other books include financial services, revolution 2020 digital assets 2022.

10:24 am

alex a sought after for his expertise, business and government audiences. he has delivered well over 200 lectures. executive to business audiences at firms, goldman sachs, google alliance, ibm, microsoft, accenture, just to name a few. alex's tedx talk, which is fantastic if you haven't seen it, although many have actually over 800,000. it's called blockchain is eating whilst wall street and it's been featured in the new york times, harvard business review, globe and mail, the national post, fortune and many other publications. his current book, web three charting the internet's next economic and cultural frontier, has become an international bestseller, and the wall street journal and, the globe and mail. in 2017, alex, the blockchain research institute bry, a global think tank investigating blockchain strategy opportunities and use.

10:25 am

alex is a graduate of amherst college cum laude and a cfa charterholder. he lives in toronto with his beautiful family. everyone please me. welcome alex tapscott. well, you all. this wonderful audience and i have to say i am extremely humbled and quite touched by the introduction from elizabeth and from john as well as a proud canadian. you know, i try to do my best when representing our country overseas. this book tour has been an amazing journey. this is actually the last stop number, 13 and somehow i haven't

10:26 am

gotten tired of delivering this talk. you guys are in luck, but it wouldn't have been without the tremendous of a very impressive group of and countless really partners in every city. and we've already heard about the community locally. but i do want to just give one more shoutout both to our sponsors and also to the government of canada who in many of these different locations has been a terrific partner in helping bring in community partners, bring in and help to make these events a huge success. this is a really exciting time in human history, and i'm so i feel so fortunate to be with you all today to tell you a little bit about this story every once in a while, a new technology emerges, transforms the economy, power grid and the old order of human affairs in ways that are both profound and often quite unexpected. and we've seen this play time and time again throughout.

10:27 am

history most recently with the internet, before that, with the computer, you know, the inventor of the transistor and before that the television, the radio, electricity, the steam engine really all the way back to the printing. and now we're in this very interesting period where there's not one new technology, but four and they're all emerging or least they're all hitting their stride at exactly same moment. and i think each of these technologies has the potential to as impactful and potentially disruptive as any that have come before the first of these technologies is. blockchain not exactly most sonorous word, but nevertheless a very technology blockchain digital assets like bitcoin possible but really the easiest way to think of them is as a digital medium for value a way for individuals and businesses to move value, to transact and to automate complex business processes instantly without the need for middlemen like banks.

10:28 am

the second big technology is i call series. that's no surprise in french i think you might have to double check that a guy is technology that has taken the world by storm in the last year and i think has us to really confront our humanness or at least to allow us to reimagine what we thought. computers could do and what people could do when empowered with these tools. the third technology is extended reality xdr, which is word that we use to describe both our mented reality and virtual reality. for 30 years, we've had a two dimensional internet, an internet we access on computers or phones and. what extended reality promises is to the internet and turn it into a spatial web, an internet that is integrated into our natural world. and the fourth technology is iot, the internet of things. now, not just talking about, you know, glucose or smart

10:29 am

thermostats. i'm talking about connected devices that can do transactions, are economic agents and that think, thanks to a.i., i'm here to tell you today that these technologies are not separate. they are related in the same way that the term internet went from describing really narrow set of sort of networking technologies to describing a range technologies, but also new business, new social behaviors, new cultural phenomena. so too is the term web three coming to describe in this next era, with these technologies converging together, i get asked a lot, where's all this to happen? where's the next silicon going to get built? countries like canada as pointed out in his introduction, have lead in certain technologies but have never been able to capture the same kind of critical mass and vae that silicon valley had in the early days of. the web. silicon valley was once called a tech galapagos because of the

10:30 am

very unique blend of characteristics capital, universities, government r&d, workforce and so forth. that led to the unique species of company that could survive. there nowhere else. and those companies went on to dominate the next era of the web. so the question is, where is that going to get built? i think there's a really interesting for cities like detroit, for places like and others to a claim on the web's next economic and cultural frontier. and i actually think that the technologies just described can help to make that happen so start. there. yeah so let's start a core concept here. for 30 years we've had an internet of information, right? so you use the web today to send and move and share information. you're not really sending an original unique you're sending a version or a copy. so if you send an email to someone, you can send the exact same email to someone else.

10:31 am

and if you, you know, attach a document to it, you can send copies of that document to everyone. if you a web site, anybody can see the content if you write something on twitter or an entry into wikipedia, you upload a photograph on instagram. it's available for all to see. so the internet is kind like a printing press for information, right? a digital printing press. and just like the first era of the printing press, it is transforming and democratizing access to information. and overall, it's had a positive impact on the world, except when it comes to things that have value, things like money or other assets, stocks and bonds titles or deeds being to create copies of those things is actually not such a great idea. so instead of sending an email, let's say i'm sending elizabeth $20. it's very import that when she receives that $20 that she knows i don't still have a copy and. i can send the exact same $20 to

10:32 am

someone else because if i can copy money and asset, it's the way that we can copy information those assets become worthless right and this is actually a very specific computer science problem that people have been trying to figure out for a long time. it's called the double spend problem. how do you ensure that when you move of value online that you can prove that the person still doesn't have a copy, that there isn't still a trail of digital breadcrumbs behind? and this is a problem. you know, a lot of very smart people as said, have been trying to figure out marc andreessen, inventor of the web browser, was tried originally to put money as widget into the browser. elon musk, the original predecessor to paypal, was originally as a digital money project. but none of these very smart people could figure out this problem. and because of that, even though the web has transformed our world in profound and important ways, we still rely basically on middlemen for all sorts of

10:33 am

transactions both offline and online. now, these middlemen are familiar to us, of course there's banks and brokerages and other financial services companies, but increasingly big tech companies, what we call digital conglomerates, are acting as the economic of commerce online. and overall, these middlemen perform some important roles right? they establish the identity of people in transactions who the buyer, who's the seller, who's the sender who's the receiver? they do all the business logic clearing and settling, record keeping and so forth, and they establish trust between parties and for doing so. they get compensated, i would argue quite handsomely as a now over all these middlemen, they do a decent job, but have some very specific limitations. they're centralized, which makes them vulnerable to hacking or to attack. they add costs and slow things down. they exclude big parts of the population who can't participate

10:34 am

fully the benefits of our global economy. and they capture all this data about us, which is problematic for a couple of reasons. one, we don't own it so we can monetize it. and two, it might end up in wrong hands. so what if the internet was entering a new era from an internet of information to internet of value? well, in 2008, an anonymous person, persons named satoshi nakamoto, developed this thing called bitcoin who sort of bitcoin? just kidding. you've all heard of bitcoin. bitcoin, all the hoopla and there's a lot of hoopla was designed to solve a simple problem. it was designed to be cash for the internet, a way for one person to move value over the internet to another person without the need for a middleman, just email allowed us to move information from one person to another without having to go through the postal service. right. that's all it was trying to do and what was remarkable about it was that it worked.

10:35 am

unlike those other things that came before this one actually worked in solving the double spend problem. and it off this spark that has caught on like wildfire and captured the imagination of people in many industries with far reaching not just for finance, but for every single industry in the economy. so the internet is entering a new era, and with it the web is entering a new era. now, i know that like the same thing. i'm just going to clarify it. the internet was invented in the 1960s as a project of the us government to build a communication network that stay up and running in the event of a nuclear attack. but it wasn't until the 1980s and nineties that the internet became commercialized thanks to the invention of this called the world wide web. so the first era of the web, i the web that anybody over 35 probably remembers, we call it the dot com era, the dot com era, because we used to use computers to type in urls and to upload information.

10:36 am

and basically that was web one, a medium for presentation of pretty static information on websites and it was primitive by today's standards, but it nevertheless did something profound, which that it democratized access to information for anyone who had an internet connection. so if you were a student in east lansing or in wayne state or in dubai or toronto or wherever you type the same url, you could get, the same information, something like that wasn't before the second era of the web brought about the era of user generated. so no longer was the web, just a place to go to consume content. it was a collaborative medium. it was a way for people to upload their own, to find their own community, to share and to connect to online. and what the second era of the web allowed was. the democratization of publishing. of a sudden anyone could share photos of their grandkids and share their thoughts on the world and, you know, be a

10:37 am

astronomer, so on and so forth and that collaborative medium created this new asset class of data, user generated content and data. it's a cliche, but it's true that data is the new oil. it is the most important asset class of the digital age. just like oil and industrial plant and equipment was the most important asset of the industrial age. the only problem with web two is that we all created this data. we didn't own it. it was owned by the platforms, the big companies that we interacted. and what ended up happening in web was that the big killer business model just basically became advertising. and so platform worked really hard to keep people hooked with recommendation engines to gather more data so they could sell more ads. and that was problematic for a lot of reasons. but one that i think the big one is that we, as internet users didn't really get to participate in any of that value creation. so the web and with it, the

10:38 am

internet are entering a new era. enter web three or the ownership the read write own web. so now not only is the web a way to access content or to share your own content and ideas and so forth, but it is a new platform that allows us to own and manage our identities and our own data to, control our own assets, and to be able to own and monetize our own digital creation as it is a new operating system for the web that in my view promises to put more power in the hands of individuals at the expense of platforms. what i'm going to do today is walk you through six transform nations, starting with what i think is the most elemental and going and sort of bigger and bigger concentric circles if you'd like to understand more, encourage you to read the book because we get into that in detail. so at the very core of this are

10:39 am

assets. now i hear a lot from a lot of people this question about cryptocurrency seems right. i don't really understand why we have so many currencies. what are all these currencies for or why or why do we have all these virtual assets or virtual currencies? and i think that in the words that we use are, just incorrect most of these digital assets are not currencies. currencies, very particular thing. the us is a currency. the canadian is a currency. bitcoin is trying to be a currency. a currency needs to be a store of value. bitcoin is volatile, but it's proven to be a decent store of value. it needs to be a medium of exchange. yeah, we use that. it needs to be a unit of account. what was the last time you went to the local car dealership and bought a car priced in bitcoin? i'll take the toyota tundra that'll one and a half bitcoins. so not yet a currency in that respect, but vast majority of these other assets aren't trying

10:40 am

be money the best way. ink about digital assets tokens is as containers for value. so in the same way that a shipping container can contain furniture, clothing, canned goods, computer, you name it, right? it's an open vessel. you can fill it with whatever you want. a token can be programed to contain anything of value money, financial assets like stocks and bonds or other financial goods, commodities and other natural assets titles and deeds even votes in an election. the vote is kind of like a transaction if you vote, it's important that when you vote that it's cast and counted, that it's counted only once that everyone can prove that it's counted one spend that you can also verify it right kind of like sending money to someone so a token is a blank canvas that allows us to program anything of value digitally. and what's really remarkable,

10:41 am

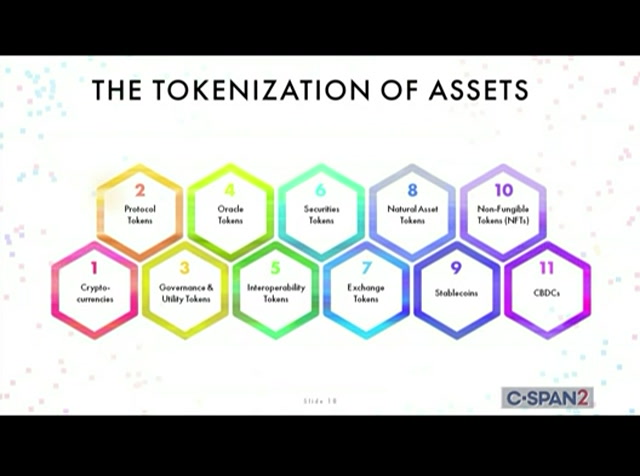

exceedingly remarkable about tokens is that they're also software, so they can be programed. so you can include all sorts of complexity into these asss, money that only works in certain conditions, right? so securities that have embedded in them all. the contract logic to pay out dividends, all of this stuff is just ones and zeros that can be into the contract. so i've been working on this tokenization taxonomy for some years and i keep adding more widgets to the taxonomy right now? there are about 11 and i'm not going to go through each of these, but important to note is that currencies just one of 11 different types of these tokens. you know, there are tokens here that have got nothing to do with money. nft is nonfungible tokens. those are unique digital goods can be used to represent art collectibles contracts. every contract is slightly from the next one, so we can use nft for that. cbdcs well, those are digital money issued by governments

10:42 am

that's got nothing to do with cryptocurrencies. as you can see, there's various different categories now a taxonomy like this is right now because we're early and so it's good to know kind of what's out there. but i think pretty soon a taxonomy of digital assets seem kind of silly. it would be sort of like having a taxonomy of websites. you know what, are the things that we can do with a website. people were asking themselves this in the nineties maybe we can put sports scores or classifieds oh, we can get the weather and encyclopedia. yeah, that's a good idea. and so we had this sort of thing like here are the ten things we can do with a website. of course today we know that websites are like containers kind of infinitely programable right? you can have a website be anything infinite of different store fronts or websites and landing pages and so on and so forth. so i think eventually a token taxonomy like this will seem kind of silly, but for now i think it's useful. the second transfer mission is to the individual. so as i mentioned in my remarks

10:43 am

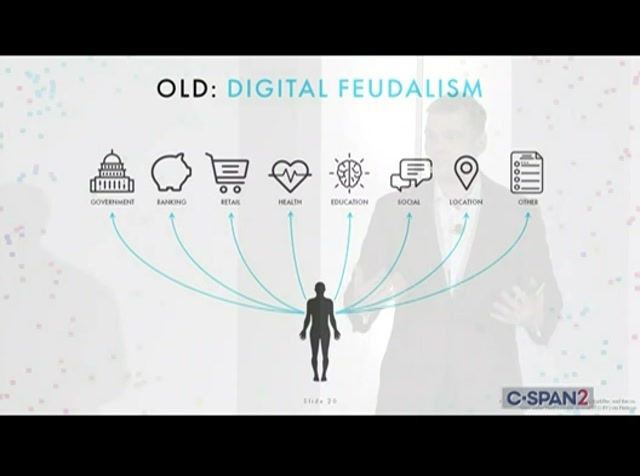

about web two user generated content data became the most important class of this era. and we all create this data, but we don't own it or control it. and in a way it's sort of like digital feudalism, you know, you are on the you're working the land, the digital land, and you're creating this thing of immense value of data. we know it's because the market capitalization of the biggest companies in the world is in the trillions of dollars. they're all pretty much tech companies that have leveraged user generated data. and you're creating all this data and you're giving it away free and then in return you're receiving access to some free service, right? sort of like giving your produce to the landowner and receiving a couple of cabbages a result. so what web3 promises is to basically reverse this model where instead of you handing over all your data and all of your creations and all of your

10:44 am

attention voluntarily to these platforms, you get to own and control it through a thing known as a self-sovereign identity. so who's sort of a digital wallet? just want to get a show hands most. so you can think of a digital a lot like regular wallet, right a regular wallet contains money, maybe not days, but usually it contains money and it also contains ways to unlock more money. you credit cards, debit cards and so forth. but it also contains credentials, data about yourself and so on and so forth. so where i come from in canada, we have these things, health cards and you can a health card into a hospital and get free health care. it doesn't matter who you are, it just works like that. it's an amazing concept. you guys should try. but that's basically a way for you. prove a credential data about yourself, order to unlock a service so a wallet is very similar. a wallet will contain money and assets, right? the a wallet in your pocket

10:45 am

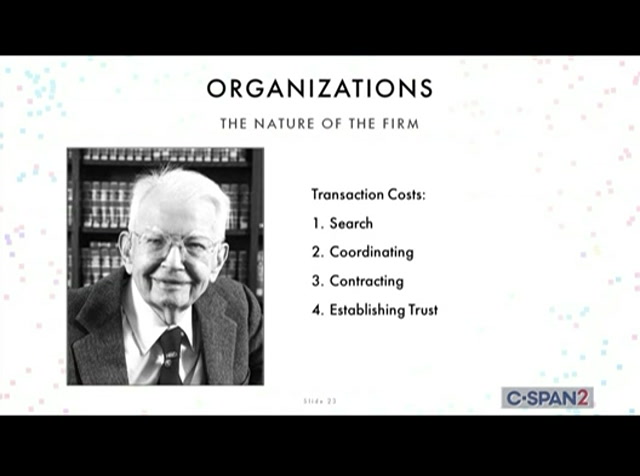

contain a $20 bill, but it can also contain data and credentials about you that allow you to access and control your identity right. and so we've never had a way to do that online, but now we do with a self-sovereign identity. the third transformation is to organize nations themselves. so this is a famous economist named, ronald coase, and ronald coase has a very deep connection to the city of because ronald coase in the 1930s wrote this very important paper called the theory of the firm, where he asked a simple question and for asking it well, really for answering it quite well. he won the nobel prize. he said, why do companies exist? why do we have firms? this is perhaps a question you've asked on a monday morning into the office. why do we have firms. no, he was basically putting the firm in the context of the market.

10:46 am

he said if the market is the best way to allocate and to organize people and to build value and so forth that's what adam smith and classical economists said. then how come everyone's not an independent contractor bidding in an open market? and he said the reason and he won the nobel prize for this he said the reason is transaction costs so long as it's cheaper to do something inside the boundaries a firm then companies will grow because that's the most efficient path right? so he was looking at the time at companies that were operating in the twenties and thirties, the biggest corporation on the planet was the ford motor company. he said, look at the ford motor company. the ford motor company doesn't just make cars. they have a timber mill, they have a rubber plantation. they have steelworks. the plant in detroit didn't, you know, take parts and assemble cars the way they do today. it put in raw materials in one end and output vehicles on the other. henry ford understood that the transaction costs, the costs of

10:47 am

search, finding information the cost of coordinating all these different parties in a complex supply chain, the cost of contract writing, the cost of establishing trust. all of these things were to expense in an open market. so we just vertically integrated the firm and that's basically the way companies looked for many decades. but technology tools helped to start to unbundle the company, right? so all of a sudden the mantra was, focus on what you do best. and offshore the rest. all of those costs began to go down, the cost of finding information, it's a lot easier find information. you can do a google search, right? or even when you can just check the yellow pages, it's lot easier to communicate when you have access to a fax machine or to a telex and later to email to zoom. right. it's a lot easier to do contracting, actually. it's not that easier to contract them now, but those costs have also declined a little bit. so today, you know, what's the ford motor of today? it's probably apple, right? the biggest sort of industrial company. but they don't really make phones. right they design them, they market them, but they don't make them. they have a chain that includes

10:48 am

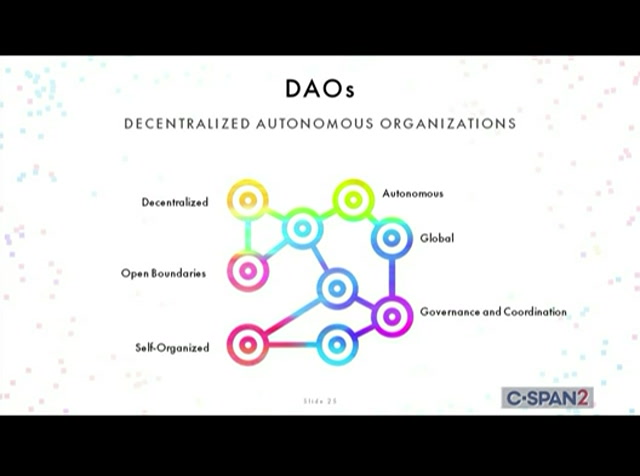

160 different companies in china alone, dozens more in other countries because tim cook and the executive team, apple understands that because. those costs have gone down. it's easier to do things in the open market. so fascinating about blockchains and web3 is that they promise to accelerate this process in ways that we haven't really experienced. so far. now we're going to hear from a bright young person on who has formed this thing called a dao with other university across the world. a dao is a thing that stands for decentralized autonomous organization. it's bit of a mouthful. i think a better term is a thing called a user owned network where basically anybody who is both a customer or a vendor or a partner or an employee of, a company can be an owner can parties paid and the value that's getting created. so if you wanted to start a new business today, let's say it was

10:49 am

a software company and you wanted to offer it to people in 50 countries all around the world and you wanted to make it super easy for anyone, including your users, to be an owner. right? be great customer acquisition shout. customer acquisition strategy to offer your customers ownership in your company. imagine if you were facebook. i would have loved that back of the day. so how would you do it with a company? well, you'd have to have legal agreements in 50 countries. you'd have to translate into a dozen languages. it would be just complex, too, prohibitively expensive. but with a dao you can have a token reward that anyone can earn and own by participating this network and maybe a user's own network would pursue a different strategy. then a company, maybe a user owned for social media would say we shouldn't have advertising that uses recommendation engines to pollute our children's minds. example. maybe we would make other kinds of choices. so a dao is a new to organize

10:50 am

capability and to engage communities globally, and i think eventually will begin to replace corporate in many industries. so next up, industry is so it's the second dude in my deck. this is clay christensen. clay christensen wrote a very important book called the innovator's dilemma. who's heard of this book, the innovator's dilemma? few. okay, so i'll summarize the thesis. he basically said the question that he asked was why, is is when a new technology comes along. really successful companies today have a hard time embracing it and ultimately fail. why is it that well-run businesses, not badly run businesses, but well-run businesses can't figure out how to manage the transformation. and he pointed a number of reasons. one of them was that markets that do not exist cannot be analyzed not only as the opportunity on known at the time, but it's unknowable. so your company and you see a new technology come along, pick a technology. i okay. i how can this help me to do

10:51 am

things differently? well, maybe i will replace people in my call center, for example. well, that might be true. or maybe blockchains will help to reduce the complexity of transactions and cut costs for my company. or maybe extended reality will allow me to open a bank branch in the metaverse or something like this. these are how legacy businesses thinking about technology, but oftentimes the way in which technology changes industries is much weirder and much more profound than just cutting costs and making things a little bit more efficient. usually they create something new that we anticipated before. the early in the 1990s was all about how do we take broadcast medium and put it online? let's put newspapers, magazines and radio stations and classifieds and encyclopedias on the internet. but it wasn't until a decade or two later that we realized, well actually it's social media and uber and airbnb and these other sort of geospatial of companies. that was the real pony there was more innovation there, but we couldn't see it in the days. i think the problem exists today in a lot of industries, how this how is this technology or set of

10:52 am

technologies going to change different industries and where are we on the growth curve? this is the the s-curve, which says in the early days, there's lot of r&d but not a ton of growth. then all of a sudden things hit an inflection, right? and they shoot up where every dollar that goes into innovation creates $10 of output cars are a good example. we're here in the motor city. the first couple of decades of the development of the automobile there wasn't a lot of growth, right? there was a lot of experimentation. people thought cars were going to be a fad. and then all of a sudden, we figured the internal combustion engine, where dollar and every year the car that much better and more efficient and sold that many more units but eventually it petered out where it doesn't matter how much more money we put into internal combustion engines, we can only squeeze that much more energy out of a hydrocarbon. and so we need a new technology to take us to the next level. so it's about all of the technologies of web three is

10:53 am

that they're basically emerging or hitting their stride at the same time, i think from the outside looking in, technologies can seem like an overnight success story. i think chad schubert is the ultimate example of this right? well, i just came out of the blue. wow. air is a big deal. of course, has been many, many decades in. the making the first moral panic about ai occurred in the 1960s when people were said they were going to take all our jobs right. so these things take time. but i think we're all hitting our stride right at the exact moment. so what does this mean for industries. well, let's start with financial services. who knows what that thing is on the screen? but anybody. yes, right. a rube goldberg machine or device. so a rube goldberg machine is this complicated apparatus that performs many steps. the more steps, the better. and all of them totally unnecessary, because in the end, all of the rube goldberg machine does is do a simple task like it cracks an egg or closes the door

10:54 am

or something like that. i'm not sure what industries you folks work in. i'm in the financial services industry, so i'm allowed to say this. this is basically the way the financial industry today where, you know i mean, in every part. right. so even the stuff that everyone's used before, you go to starbucks and you tap your card, the card reader, and you think, wow, look, that the money is moving digitally from my wallets to that device. but it's not it's going through your bank. the bank credit card process and company foreign exchange. in my case know, risk check. and in the end doesn't settle instantly. it takes days sometimes weeks, and it costs 1 to 10%. if you think about trading. right. so anyone use like robinhood or one of these sort of like, you know, discount brokerage apps you press by and fireworks off congratulations you've bought bed and beyond you're going to be broke soon, you know. good for you. and you think boat finance so digital but actually when you

10:55 am

buy that it's going through your broker the broker for the seller there's a transfer agent a custodian clearinghouse exchange you name it right. and transaction settles plus two t meeting time plus days. so it's a weird concept. like, if you use the web, if i send you an email, you get it instantly. if i sell you stock or i send you money or we do any transaction, it takes days and weeks and costs all this money. it's just a bizarre concept. so really a lot of financial innovation, what we call fintech is really just digital wallpaper. it's a fresh coat of paint on the old industry. right. it's a new, sleek user interface that makes interacting with the old banking world just a bit more appealing and a little less painful. but it's not getting at the deep root of things right. it's not fixing the plumbing or the electrical, the framing or this deep structure of, the industry. it's just fixing something on, the surface. so what's interesting about defi decentralized finance is that

10:56 am

defi is trying to reimagine every aspect, what the industry does not, just how we move value, but how we store value, how we access credit, how we connect entrepreneurs with investors how we do insurance, how we exchange assets and so on and so forth. and defi today is relatively small. the total asset value that's in this ecosystem is less than $100 billion, which sounds like a big. but it isn't when you think about how big the industry is, but very leaders in the banking world paying attention. the ceo of one of the biggest banks in the world said to me, you know, people think our business is complicated, but it's not. he said, we move money because we move. we get to store money. and because we store money, we get to lend money. and that's whole business. we're a lender. so you actually start to disrupt the moving money part. then the whole foundation for the industry starts to look a little bit shaky. so leaders in a lot of

10:57 am

industries understand that even though their business feels secure, they may be standing on a burning platform and. i think financial services is an example that. so what's unique about, defi, is that all of the application is in each of these nine different sectors, it's not being spearheaded. some traditional company usually it's a user owned network in the same way that is kind of a user network. so i'll give you an example. in the exchange of value, there's a project called uniswap uniswap is a user own network that allows people to trade different kinds of now in exchange like a think of a stock exchange, the new york stock exchange. right, is useful if there's liquidity. so what that means is if i need to go buy $1,000 of a stock, i need to know that there's some stock for sale because. if there isn't that exchange, it's not very useful. so uniswap is starting an exchange scratch or how do we

10:58 am

create how do we drive people use this platform. i know we will incentivize liquidity with ownership. so the more basically you use the platform, the bigger a share of that platform you get to earn. be sort of like the old days of the new york stock exchange. they used to sell seats. you know, you could buy a seat on the exchange where you get to earn a seat on this exchange by being an active user. so today, uniswap a platform that does some days billions of dollars of transaction, offers more trading pairs. so more ways to buy things than any other exchange of its kind in the entire world. and it is entirely a user owned network. so owned networks can be built in each of these different areas and begin to chip away at the business of big banks. so we think of this as a financial technology, but it isn't. i'll give you another example. physical infrastructure. whato you telecoms and banks have in common?

10:59 am

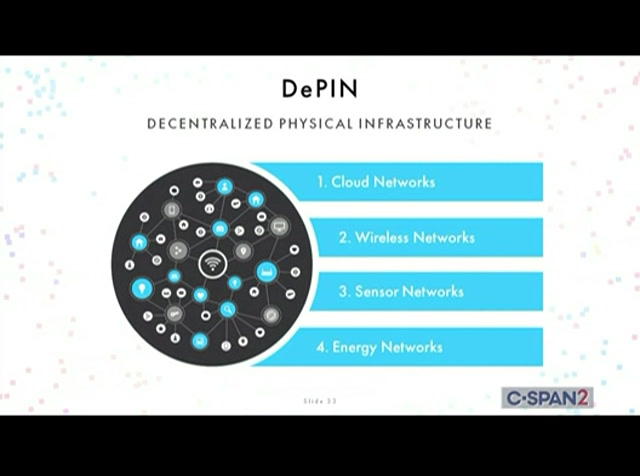

they're really big. ey're entrenched. and they've got regulatory. right. they are basically like utilities in a lot of countries. if you want to launch a new bank from scratch or you want to launch a new telecom company from scratch like good luck. you need to find someone to give you billions and billions of dollars to do that. and even then you'd have to convince regulators and so forth to let you do it. but so what's so fascinating about web3 is that we can use this concept of a user owned network to bootstrap projects that tackle the most entrenched industries. so i described financial services. another one is physical infrastructure. so imagine, if you will, a world where there are billions of people countless companies smart contract x, autonomous agents, you know, and connected devices, all needing to transact to prove identity, to move and store value, to coordinate in real time. that kind of thing is not going to happen using the vision

11:00 am

network or with existing tech companies need a new operating system. the internet of things needs a ledger of things. and what pioneers are doing is building user road networks for physical infrastructure for not just financial infrastructure but physical infrastructure. cloud networks, wireless network, sensor energy networks. in fact, there are 150 at least project sites in the world of web three that are doing exactly this. so i'll give you a couple of examples. there's a project called the render network that allows individuals and businesses to basically contribute or their computers into a network. right. and those computers then be used by film studios or a.i. companies to train models or render cartoons. and the users get the benefit of cheaper computing. and the people who own those computers, the benefit of earning a little bit of extra money. so these user owned cloud

11:01 am

networks are now adding, complementing the existing physical that exists. there's another called hive mapper, which i about in the book that's trying to dislodge the google maps monopoly. so google maps isn't just a consumer facing application. it's also the mapping data for your local state house, your local insurance company, hospital ambulance services, you name, it. and right now, we have one company that provides all the data. so what hive map has figured out is you give people a dashcam, they can put it on front of their car. they'll drive around. they'll able to map the world much quickly and readily and with far greater than a google truck could. because it doesn't matter how many google cars are on the road, they're always going to be more cars that aren't google cars than our google cars. and all you need is a few hundred cars on the road. in a city like new york. and you can map the city every few weeks. so hard maps in one year has maps. 10% of the world's surface or 5 million kilometers of roadway. and in like new york and seoul and los, their data is better

11:02 am

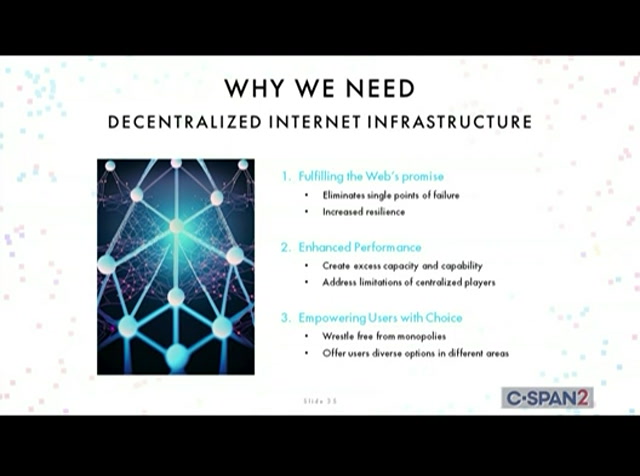

than the data that google maps has created. so apple, microsoft, these companies have spent billions of dollars to try and compete with google maps and the failed pretty much. but with web3 technology, a bunch of users can get together and can potentially do it themselves. so why is physical infrastructure a decentralized physical infrastructure important? well, number one, it sort of fulfills web's promise in a way. right now, three companies control the entire cloud computing market. right. microsoft, google and amazon services. but if this is supposed to be decentralized network, that's censorship and resilient, then we should have more choice. and so what decentralized physical infrastructure is add choice. the second thing is it can enhance performance if we want to run transactions on these networks and render metaverse and do all this stuff, we need all the computing power infrastructure we can get our hands on. and so we need to create incentives for people to contribute their assets into those networks.

11:03 am

and then, yes, of course, choice, meaning simply the more choice there is, the better the competition, the stronger the results for consumers. at the beginning of my remarks, i talked about the intersection of different technologies, and i want to spend just a moment talking about a.i. so this is alan turing. alan turing, among many other things, helped to win war against the nazis by breaking their code machine called the enigma machine. he was also the inventor of a.i. of how we think about ai, and he developed thing called the turing test, the test was designed to basically assess whether a computer could fool a human being into thinking that it was also a human being. and this was supposed to be sign of artificial intelligence. and so for the past few decades, people have been fixated with this of a.i. and a.i. has gone through many periods of excitement and many periods of disillusionment. but we're now at this very key moment where. a.i. is taking center stage.

11:04 am

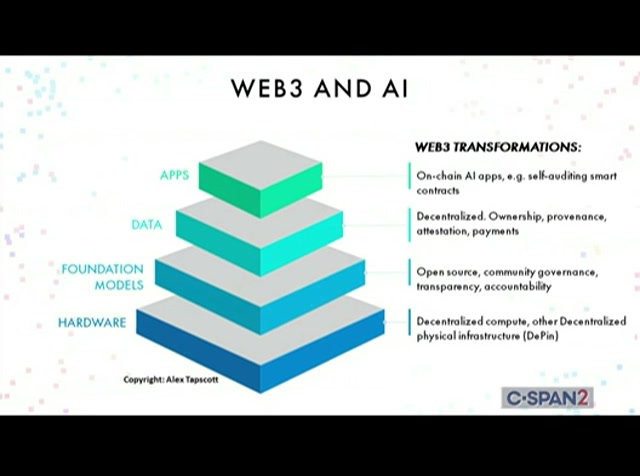

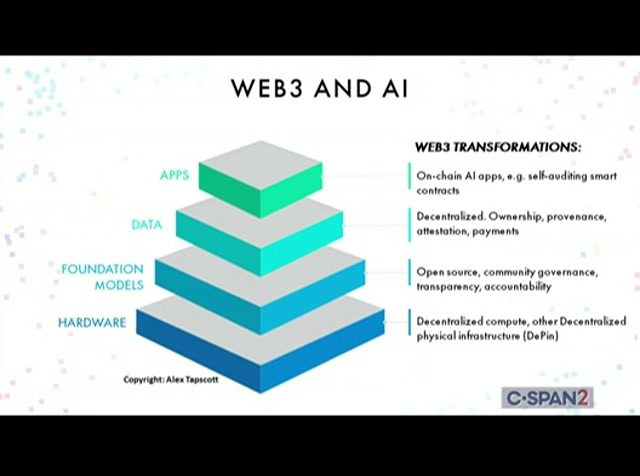

so what is the relationship between a.i. blockchain and these other technologies? well, it turns out at every single layer of the of the a.i. industry, there is an opportunity to make things better by integrating these technologies. so the first is hardware. so right now all these models are being run on in video chips, which are all, by very large cloud providers. decentralized infrastructure provides choice and adds more balance and competition to that market. the are the models themselves. open a.i. is a textbook case of bad governance. i think a lot of people read this. i actually wrote the op ed for the new york post last weekend saying that open a.i. is anything open? and what need for a.i. models if they're that if they're going to be this transformational is we need better governance. we need a way to have community input. we a way to have transparency and accountability. and so we can't do that in the

11:05 am

closed systems that we have today. data right now, data is in silos controlled by big web two companies, which is why open i still partnered with microsoft or why and from partnered with amazon and why all these model these these cutting edge tech companies. they need the big tech because big tech companies have all the data. but in the webs in a web3 world own and control their data. and so they'll to decide how that data gets used. so right now ai is centralize. but in the future it will be decentralized. and of course, there are huge to integrate ai with blockchain and these other. so take defi, for example. what if you could use all those different defi applications but you didn't actually have interact with them? you had a financial advisor who was a smart a.i. that could find the best investment opportunities and help you move and store money and do all your financial services for you all without the need for banks or traditional intermediaries.

11:06 am

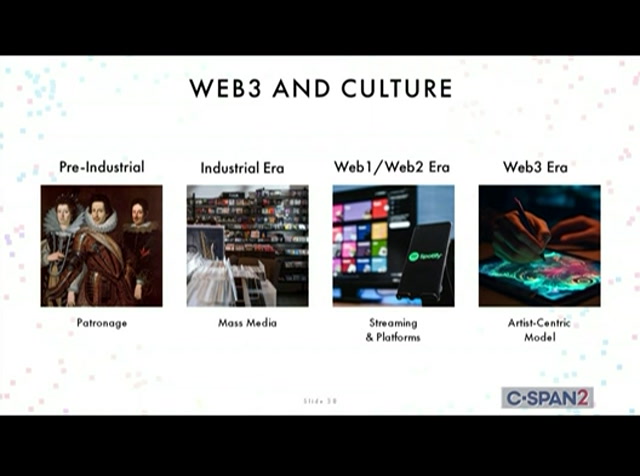

the final industry i'm going to talk about is culture, and culture is the perfect of the intersection of. a.i. and blockchain. so culture needs new business model. the business model has changed time. in the very early days in medieval times, the business model was basically patronage. you know, you were an artist like leonardo da vinci. you needed to find a patron like the leonardo da vinci to find the medicis. it's a bit of a mouthful. and ultimately, a lot of times your art reflected the ambitions and the needs and the desires of your patron. right. that's what they call the edifice. in the 20th century. it was in the 20th century that model changed because now could sell your creative work to an audience of many. so if you were an author, you could sell a paperback. if you were a graphic artist, you could sell a lithograph. if you were a musician, you could sell a record. and later a. and by earning a small amount for the sale of many units could earn a decent living.

11:07 am

now the first era of the web, web one and later web two was supposed to make this better for creators because now if you were a musician, you could sell your music directly to your fan and you didn't need to go through the record and have shipping companies and all the rest of it. you could go peer, peer, maybe use a label to help you produce it, but you'd be able to capture more of the value except that's not what happened. what happened was that this thing that was an asset a cd record that sold units of became a free commodity. it got put through the printing press of the web until value basically was worthless and a whole new set of intermediaries stepped in. spotify apple music streaming platform. so the upshot today is that labels are making money but artists get paid less on average than they ever have before. and now you have the rise of a.i. now, maybe ai creates a halcyon of creativity where we all become artists because we can use dolly to build art and do rest of it.

11:08 am

more likely, what happen is that people will try to cut artists out of the production of right. they will have a i write screenplays, do scoring for film and tv, do graphic and visual effects and creators won't own any of that. ip so culturally, it's a new business model. i think one of the biggest challenges today is that we have all these a.i. models are being trained on information and that belongs to people. ip people artists, creators, they own the stuff. you can ask who's use chachi, but most people here probably have interacted with this. the students, their hands down. but we all know they've used it at least once. twice. now, i'm just kidding. just for research. hey, you know, teachers used to say that, you know, you shouldn't use a google because that was cheating. right? so technology tools, people adapt to technology over time. so these models, you ask one of these models, can you please write me an essay about, the french revolution, but do it in style of like run-d.m.c. or,

11:09 am

something like that. you know, i don't. i'm just making that up. so it's like, how does the know about run-d.m.c.? well, it's consumed about run-d.m.c., right? every song, every, you know, unpublished work, all of their biographies and so on and so forth. and it's run dmc seeing a penny from that, if you go on to use that, make money or if you're paying open eyes premium fee and you use that, how is the money going back to the creator? so the good news is that ip is an asset and so what we can do is we can use tokenization as a way to ensure that when content is consumed that we can track the and that we can ensure the creator gets paid. so there's this whole world within web three in the nft space, the nft space has had its ups and downs but what's really remarkable about the nft space is that these are basically tokens that represent ownership of creative works. there are 300 projects that have generated at least $1 million of secondary revenue for the original creator. so what that means is that you

11:10 am

sell your work and someone else resells it. you can get paid on the resale. so if you're a starving artist and you're paid something and you sell your first work for 500 bucks and then you end up hitting it big, and that piece of work sells for $50,000, you get paid on the difference between the 550. nope. whoever bought that piece of work from you does. but because tokens are programable we can program royalties, right into them because ip is just data we can program it to ensure that creators get paid fairly this is the way we're able to scale ai and culture responsibly. i want to save some time for this extra panel cause we got some great folks. i'm going to zip through these last couple of sections. so for 30 years we've had a two dimensional internet that totally true? during the web two era, the smartphone was mainly the way we interacted with the web. so it was kind of 2.5 dimensional. right. you know, you go use your phone to find a restaurant or to hail a new beer. you're interacting with the physical world every 20 years or

11:11 am

so. the way we access technology changes. we had mainframes, we had mini computers, then we had pcs then we had smartphones. what's next right? a lot of people think it's extended virtual reality, augmented and so forth. we've already about wallets there. the software you can think of wallets is like the software for web three in the same way that browsers were software for web one. but question is what's the hardware? you know, the desktop was how we access web. one may be virtual and. augmented reality is how we access web. and this has a lot of people talking about this concept known as the metaverse. so the metaverse is a bit of a nebulous term, but most thoughtful people agree this thing is going to be a big deal. ten years ago, we spent an hour. today we spend 6 hours online. there's a concept known as a third space. so for kids third space, you got your home. that's space, number one. school number two. when i was young. my third space was a park or movie theater, something like that for kids, the third space

11:12 am

is the web, the presentation self in the virtual world is as important, not more important than it is in the physical world. so it's really only a matter of time before we are spending more time in an immersive online environment. and that a lot of big compani kind of chomping at the bit. so companies like facebook are very excited this but their vision for t metaverse i think is a little troubling. they would like you to wear their headset and through their environment, share all your data with them on, nothing. be happy and if you want to leave that environment, can't take anything with you. right? so to me, that's not some new the third space, some fulfilling. it's just virtual disneyland right at disneyland is fun but it's not. it doesn't fulfill the promise here. so what is the promise? well, i think if we're going to make this happen, then whatever this new virtual immersive world is has to do things that we do

11:13 am

in the real world. we need to have a reasonable right to privacy right. in the real world, we have a right to privacy. it's in the constitution and in online. we've never had a right to privacy. we can do that with sovereign. we need to have property while tokens allow us to be owners of our assets and our digital creations. and we need to have the freedom to transact, which means if you own something or buy something or you build something in a virtual, you should be able to take it with you. then and only then will we be to fulfill the promise of the metaverse. so civilization that's sort of a big topic. they say the technology makes the world a flatter. you may be read the book the world is flat by thomas friedman, and i think that's always been more of a promise than a reality. i think that the world today is still very deeply unequal place. there are lots of complex reasons for. but i also think it's true that

11:14 am

technology has enriched the world and has spread opportunity. so if web. one democratized access to information and web to democratize access to publishing, web three empowers people with a new toolkit to move and store value to own assets and to build wealth on a globally a level playing field and a globally level labor market. so if technology makes the world flatter but i think web3 is going to be a steam and it's going to flatten power structures and change our world in profound and, unexpected ways. the book is called web3 charting the internet's next economic, cultural frontier. and i really love the word frontier for a lot of reasons. some are for experts all linked. some frontiers require vast amounts of capital. you know, climbing mount everest, venturing to the moon and so forth.

11:15 am

and frontiers present their fair share of risks and rewards frontiers attract missionaries and adventurers and savvy people, but also hustlers, wrestlers and con men but the most bountiful of frontiers in human history are typically the ones that are pushed forward by everyday people or, at least those who are curious driven by circumstances or, interested in understanding the future. but every frontier person, no matter how hardy, requires a guide and with humility. i hope that my new proves to be a useful one. you've all come here today because you've self-styled to understand this space a little better, or maybe because you're already a leader in this field. it doesn't. if you're a student or a journalist or a business person or you're someone between careers, or you work in the media or, you're in government,

11:16 am

25 Views

IN COLLECTIONS

CSPAN2 Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11